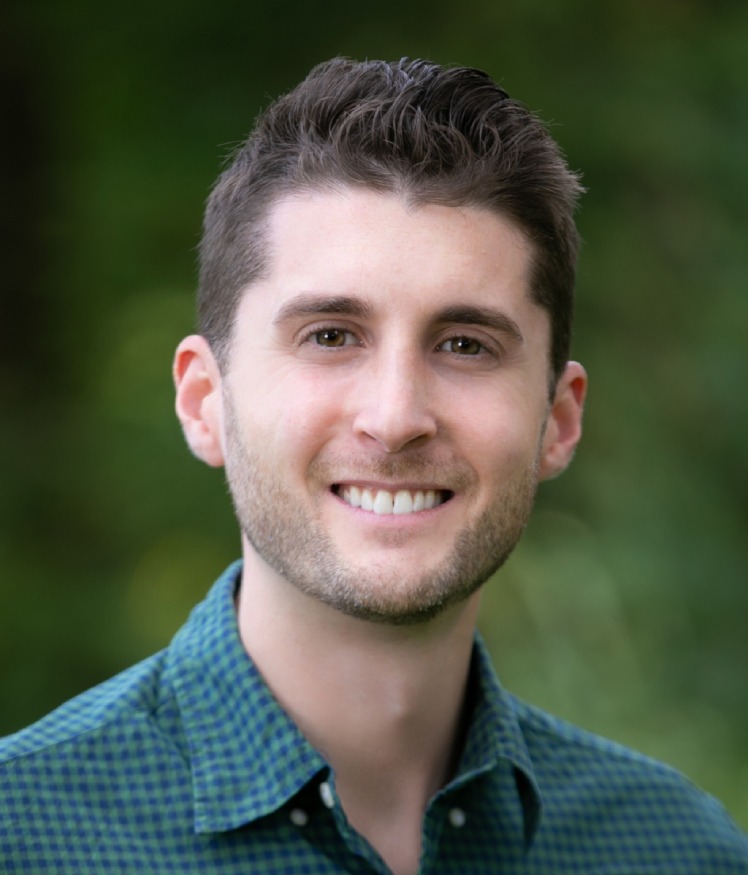

- As CEO, grew Western Smokehouse, a founder-owned manufacturer of meat snacks, by nearly 5x in EBITDA and from just over 60 employees to 300.

- Prior, 9 Years I-Banking & PE in Consumer Space, all focused on family & founder-owned companies.

- Board director roles with Kohana Coffee and The Honest Stand, both differentiated, niche-leading contract manufacturing businesses.

- Developed idea for Charis Collaborative while running Western on a slightly different but related model: three companies running discrete P&Ls leveraging one another to create a better operating environment.