Part 2: CPG 3.0 – Building next-generation CPG companies that deliver sustainable competitive advantage

The situation:

Wouldn’t you love to have a big, sustainable advantage over your competitors like Nike’s Zoom Zaperfly shoe provides to its elite athletes? In the last installment, I detailed why many of today’s brands will no longer cut it as we near the end of the CPG 2.0 era. It was an incredible period that has largely been positive: increased awareness and availability of ‘better for you and our world’ products. Unfortunately, in our new consumer landscape, CPG 2.0 brands don’t have business models that enable consistent, enduring growth and profit. Many of today’s popular and emerging brands are burning cash with little chance to deliver strong sustainable EBITDA. While not widely discussed, there have been a significant number of $50M+ brands with failed attempts at selling because of low margins from a flawed business model. On top of that, many of the “successful” brands that were acquired by strategic buyers, have been recently resold or shut down because the buyers saw no path leading them to sustainable and profitable growth. So what should brands do to create a sustainable competitive advantage in a CPG 3.0 world?

The solution:

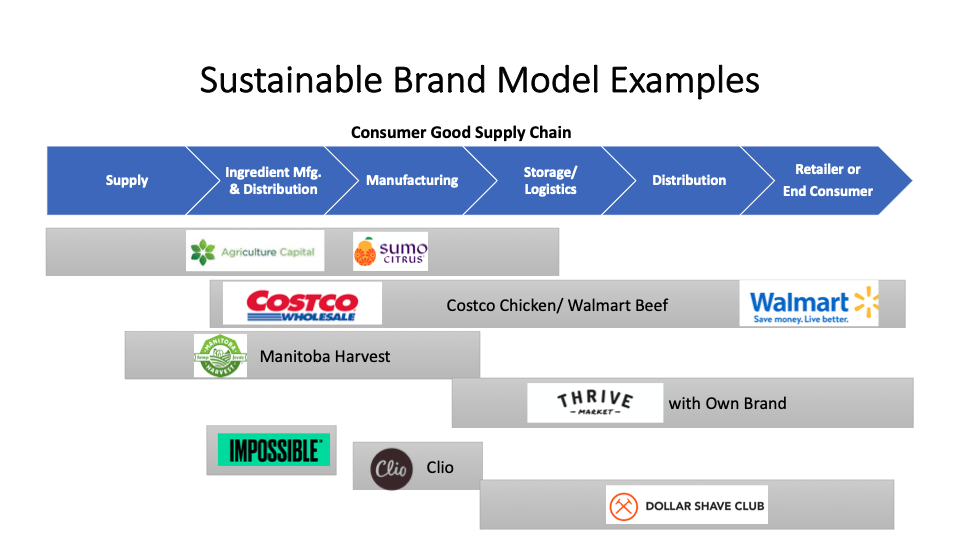

Own supply chain components that complement your brand creating an unmatched value proposition while delivering enduring competitive advantage. Let’s look at a simplified consumer goods supply chain components:

Most CPG 2.0 brands follow an asset-light model where they don’t own or have any unique supply chain capability. Note that I am not advocating full vertical integration, but rather strategically investing in the select supply chain component(s) that complement your brand proposition to create a differential advantage. Examples include direct sourcing or production of ingredients/materials, a unique manufacturing process/technology, manufacturing, owning a distribution channel (direct to consumer, app’s, etc), consumer acquisition capability, or your consumer interface. Let’s work through a few different case studies:

@Agricultural Capital: Agricultural Capital has acquired blueberry, orange, and grape farms and combined them with nurseries and processing manufacturing assets. They are now developing unique varietals with unparalleled taste and function (i.e. easier to peel) under their own brands’ names – like the incredible Sumo Citrus Mandarins. Because they own the full supply chain they can create difficult to replicate value propositions. In addition, they sell direct to retailers eliminating multiple middlemen allowing more product quality control and a higher margin.

@Costco & @Walmart: Yes, retailers are investing in their own brands and building sustainable advantage. Costco invested $450 million in capital to build a plant capable of processing 2 million chickens with a network of 520 farms. This investment will ensure consistent supply and allow them to maintain their $4.99 price point. Similarly, Walmart has developed an “end-to-end” Angus beef. The plant will not only allow a lower price point but will also “provide customers with unprecedented transparency throughout the supply chain and leverage the learning we gain across our business.”

@Manitoba Harvest: Manitoba harvest provides a “seed to shelf” approach to hemp (hearts, powders, oils) by providing farmers their proprietary seeds and signing off-take contracts with farmers that require them to follow their required agronomic practices. Such a proprietary supply capability provides a hard to replicate higher quality product and brand proposition.

@Clio: Clio makes refrigerated yogurt bars at affordable price points. Having a fully refrigerated coated bar process is not commonly available at co-packers today, so they built it themselves. That know-how and infrastructure allows them to control quality, deters competition, lowers price points, and can potentially allow for deeper relationships with retailers by producing private label options.

@Impossible Foods: Impossible Foods’ aim was to make a plant burger that had the same qualities as beef. They developed an in-house fermentation capability to manufacture their key ingredient – heme. Fermentation, while incredibly capital intensive, allows them to have a consistent, cost-effective supply that uses significantly less water and lower greenhouse gasses than certain animal proteins. No doubt it also provides considerable patent protection and process know-how relative to new entrants.

@Thrive Market: Thrive Market curates products that serve the organic, non-GMO shopper and delivers healthy goods via their own facilities straight to homes at a great value. The focused, high-quality consumer base makes them a must-have retailer for emerging brands and allowed them to quickly build a scaled direct distribution network of ambient products. As they have matured, they have curated their own private label line around those standards.

@DollarShaveClub: An early CPG 3.0 company, Dollar Shave Club used unconventional advertising methods and a unique go-to-market approach. They took on big CPG by making their own line of razors at an incredible value and selling them directly to consumers on subscription. They have spawned a host of followers from Warby Parker in eyewear to Casper in mattresses.

The bottom line

Over the last year, I have seen many P&Ls across the CPG supply chain. More often than not, companies that focus on other parts of the consumer good supply chain (sometimes with brands, sometimes without) are often some of the most EBITDA profitable.

Building these capabilities is definitely challenging – requiring significant capital, proprietary relationships, technology, processes, and know-how. However, the end result often delivers a brand proposition that other brands can’t match, including more value to the end consumer, difficult barriers to entry, cost advantage, and supply chain control. While these brands are harder to build and scale, they each have an imperative of our CPG 3.0 world – sustainable competitive advantage that will lead to profitable growth.

In my final post of this series, I will share why CPG 3.0 brands will use their competitive advantage to drive purpose.