Part 1 – Consumer Goods 2.0: Better for you brands without sustainable competitive advantage

For years big iconic brands dominated our landscape. Consumers were loyal, private label was minimal and big CPG had the power balance with retailers. $1B+ brands dominated, and retailers concentrated on driving profit through brand extension and cost-cutting initiatives often at the expense of the consumer. I term this period Consumer Goods 1.0.

Thankfully over the last decade, Consumer Goods 2.0 emerged. Small brands with more natural, better for you formulations and better for our world brand propositions took share and defined the period. The movement was led by brands like @SeventhGeneration in cleaning, @Tactcha or @DrunkElephant in beauty, @Krave in food, @BlueBuffalo in pet.

What made this possible after a few decades of Big CPG dominance? The main cause was reduced barriers to entry enabled by two phenomena: (1) a shifting media landscape and (2) the rise of a broad contract manufacturing landscape. In media, the rise of digital marketing and social channels conspired with the decline of mass media to allow brands to build large consumer audiences at a lower cost. In manufacturing, the evolution of copackers enabled brands to enter the space without much capital.

Private equity and venture capital fueled these new brand strategies and, over time, retailers did as well. What were once small, discrete natural/organic sets merged with mainstream sets. Big CPG, incented by considerable share loss to these upstarts, fully embraced the trend, ultimately purchasing many of these brands at robust valuations.

The end of Consumer Goods 2.0

After a long period of immense growth and big exits, the consumer goods landscape had changed entering 2020, even without considering COVID-19’s impact.

- Natural product launches have exploded: New product launches doubled from 1998 to 2016 (L.E.K analysis), and are now total over 30,000 per year (Nielson). A deep service industry has developed to allow brands to commercialize new products efficiently and quickly.

- Natural brands can outsource everything: product development, marketing, sales, supply chain, accounting, and co-packing to allow entrepreneurs to create and scale brands quickly with just a few full-time employees.

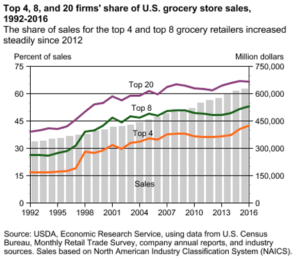

- Retailers have consolidated: Retailers continue to consolidate and grow share. Between 1966 and 2016 the top 20 largest food retailers’ share grew from 42% to 66.6% (USDA). In parallel, Amazon and Walmart dominate the online space. With fewer retail channels, their bargaining power has risen. Slotting, fees, promotion requirements, and pricing power have all compressed margins. On top of that, retailers’ trial periods are shorter, making the cost of distribution and driving velocities to maintain that space much higher.

- Rise of direct eCommerce: Direct eCommerce has grown quickly, particularly in beauty, personal care, supplements and pet. In one sense, this provides a competitive advantage vs traditional retail consolidation. However, it has also driven the cost of key search terms across consolidating to unsustainable heights while consumer loyalty remains low. The last mile is also consolidated with UPS and Fedex holding the advantage rather than consumer brands.

Supply chain consolidation: Private equity has invested across our food system at unprecedented levels. The result is a quickly consolidating support industry. Examples include @UNFI and @KEHE in food distribution and@LineageLogistics in Cold Storage. - Private Label: Private Label share in Europe rose to 30%+, with Spain, Switzerland and the UK above 50%. The US market is now slightly above 19% in 2020 (PLMA) and growing steadily. Private label is not just replicating low-end discount brands – the largest % growth is actually happening in premium items. Driven by own brand retailers like Aldi and Trader Joes, traditional and online retailers including Costco, Kroger, Amazon, and Thrive are finding that their own unique brands are one of the few means to truly differentiate.

The demise of Consumer Goods 2.0 presents a depressing and dire picture for our consumer system and brands. However, Consumer 3.0 is emerging. Successful companies are creating true points of competitive advantage resulting in sustainable and profitable success.

In my next post, I will share how we can build next-generation Consumer Goods 3.0 companies that deliver sustainable competitive advantage.